Stripe vs Shopify Payments: What Are the Differences?

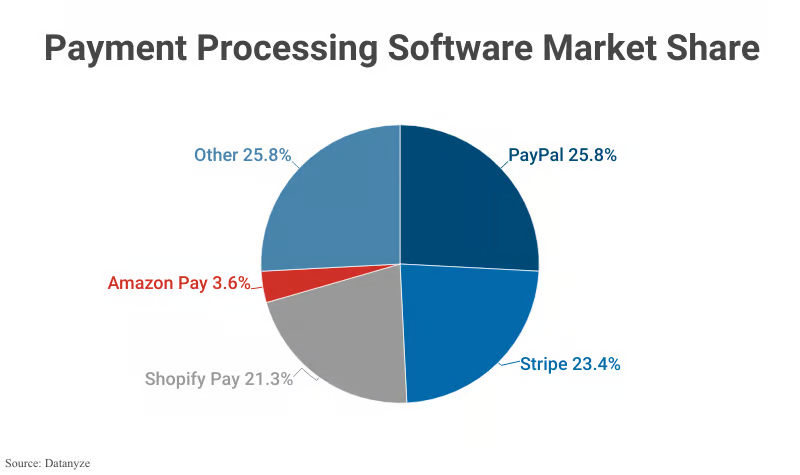

When it comes to eCommerce, choosing the best payment gateway is an essential choice that can play a critical part in your business’s success. Although there are many available options, those that tend to dominate the market the most are Stripe and Shopify Payments.

Stripe is a powerful and versatile payment processor. That’s perfect for businesses looking for a more tailored approach.

Conversely, Shopify Payments is an integrated payment processor created explicitly for Shopify stores, providing smooth integration and easy-to-use features for merchants looking for an all-in-one solution.

Throughout this comprehensive blog, we will discuss the differences between Shopify payments vs Stripe and gain an understanding of which one is better for your eCommerce business.

Stripe Pros and Cons

Source: Capital One Shopping

Pros of Stripe

- Global Payment Capabilities: Stripe enables payments in more than 135 currencies, making it easy for businesses to create international transactions. It’s available in a lot of countries like the United States, Canada, the UK, Australia, and most of Europe.

- Customizable and Flexible: With a built-in high level of customization, Stripe is also great for businesses that have unique needs. As a subscription-based business or online marketplace, Stripe gives you the ability to customize what your buyers see when they check out.

- Rope-in Gem: Stripe will rope you into their wide array of mystical world eCommerce platforms, shopping carts, and third-party apps.

- No Underhanded Fees: Stripe has transparent, predictable pricing. The pricing is simple for most businesses: 2.9% + 30¢ for each successful card charge for domestic transactions.

- Powerful Security Features: Stripe adheres to high security standards with features such as PCI-DSS compliance, 3D Secure authentication, and advanced fraud detection.

Cons

- Lack of Built-in Store Features: Unlike Shopify payments, which is a complete all-in-one eCommerce solution, Stripe is only a payment processor. This means you will need to use a separate platform (such as Shopify, WooCommerce, or Magento) to build and manage your online store, adding complexity for those looking for a one-stop solution.

- Additional Fees for International Transactions: Although Stripe supports international payments, transactions involving foreign cards or currency conversions come with additional fees.

- Tech-focused: For merchants new to eCommerce or those without a technical background, Stripe’s API driven approach can be a bit overwhelming. While the customization options are powerful, they may require developer skills to implement fully, making it less accessible for beginners.

- Charges for Refunds: One notable drawback of Stripe is that it doesn’t refund transaction fees when you issue a refund to a customer. This means you are still paying the original transaction fees even if you return the payment.

Shopify Payments Pros and Cons

Source: Demand Sage

Pros

- Seamless Integration with Shopify: No need for third-party apps or extra integrations! Shopify payments are already built into your store, making setup a breeze. As compared to Stripe, where you need to link and configure multiple accounts, Shopify Payments works right out of the box.

- Lower Transaction Fees: If you use Shopify Payments, you can avoid the extra fees that come with using external payment processors like Stripe. You’ll only pay the standard credit card rates, which is a win for small businesses looking to save on costs.

- Easy International Payments: Shopify Payments supports a wide range of currencies and regions, meaning you can expand your customer base globally.

- Faster Payouts: Shopify Payments often provides faster payouts than third-party processors. Depending on your Shopify plan, funds are deposited directly into your account, so you don’t have to wait long to access your earnings.

Cons

- Limited Payment Options: While Shopify Payments covers most major payment methods, it doesn’t support every payment gateway out there. For example, if you want to use PayPal as a primary processor, you’ll still need to add it separately.

- Restricted Availability: Shopify Payments is only available in 18 countries and regions. If you are located in a region where it’s not supported, you will need to rely on third-party gateways like Stripe or PayPal.

Stripe Features Overview

Stripe is a powerful and flexible payment system with many features that can enable your business from various angles. Accept payments online and in-person for startups and enterprise.

With flexible integrations and support for a wide range of payment methods, it is an ideal solution for any merchants looking for reliability as well as scalability. Below you can find some details about the biggest advantages of Stripe payment processing:

Accepted Payment Methods

Stripe enables businesses to accept various payment options such as:

- Visa, MasterCard, American Express, Discover, JCB and other credit and debit cards.

- Digital wallets (such as Apple Pay, Google Pay, Samsung Pay, etc).

- Payroll credit: Bank transfer and ACH

- Pay in installments for services like Klarna and Afterpay.

Implementation Options

Stripe provides multiple options for integrating with payment processing with your website or app, as in:

- Customizable checkout experiences that are either embedded directly or hosted on your site.

- Click to pay with a shareable payment link.

- In-person payments via Stripe Terminal (perfect for retail outlets).

- eCommerce platforms can connect to WooCommerce, BigCommerce, and Squarespace.

- Recurring charges, subscription-based payments with custom invoicing features.

Sign-up and Payout Schedule

Stripe makes it easy to start accepting payments with no upfront costs or contracts:

Quick online sign-up process with no need for banking details to get started.

- Flexible payout options: Choose between daily, weekly, monthly, or manual payouts.

- Funds are typically available within two business days, though timing can vary depending on your bank, location, and payment method.

- You can close your account at any time without worrying about cancellation fees.

- These features make Stripe a great choice for businesses looking to streamline payments and expand their global reach.

Shopify Payments Features Overview

Shopify Payments is Shopify’s integrated payment processor, offering a seamless and straightforward solution for online store owners. By using Shopify Payments, merchants can accept payments directly within the Shopify ecosystem, making it easier to manage everything from sales to payouts without the need for third-party gateways.

One of the major advantages of Shopify Payments is its integration with Shopify’s POS (point-of-sale) system, which allows businesses to accept in-person payments at physical locations.

Additionally, Shopify Payments is compatible with most major credit and debit cards, as well as a variety of local payment options depending on your region. While Shopify Payments is available in many countries, there are some geographical limitations, which means that businesses located outside the supported regions may need to use third-party payment gateways like Stripe or PayPal.

Transform Brick-and-Mortar Storefront into an eCommerce Bandwagon with Shopify

Accepted Payment Methods

Shopify Payments supports a variety of payment options, making it easy to cater to your customers’ preferred methods:

- Credit and debit cards (Visa, MasterCard, American Express, Discover, and more).

- Local payment methods like iDEAL in the Netherlands, Sofort in Europe, and more.

- Digital wallets such as Apple Pay and Google Pay.

- Shopify Pay, which allows returning customers to check out faster using their saved information.

Implementation Options

Setting up Shopify Payments is simple and fully integrated within the Shopify platform. You don’t need any additional apps or integrations to get started:

- Automated integration with your Shopify store, meaning you don’t have to worry about syncing with third-party payment processors.

- You can manage your entire store’s transactions directly from your Shopify dashboard, which means everything from payments to orders is handled in one place.

- Shopify Payments also works with Shopify’s POS system, making it easy to accept payments in person and manage all sales in one unified system.

Sign-up and Payout Schedule

- Signing up for Shopify Payments is quick, and there’s no need for external accounts or lengthy processes. Once you’re set up, your payouts are fast and reliable:

- You can sign up directly within your Shopify account, and no external contracts are needed.

- Shopify Payments offers flexible payout schedules, allowing you to choose between daily, weekly, or monthly payouts depending on your needs.

- Payouts are processed automatically, and funds are typically available within 2–3 business days, though timing may vary depending on your location and bank.

Shopify Payments simplifies payment processing and makes managing your business easier by offering a simple solution within the Shopify ecosystem. Whether you are looking for in-person payment tools or handling international transactions, Shopify Payments is designed to offer everything you need for your business.

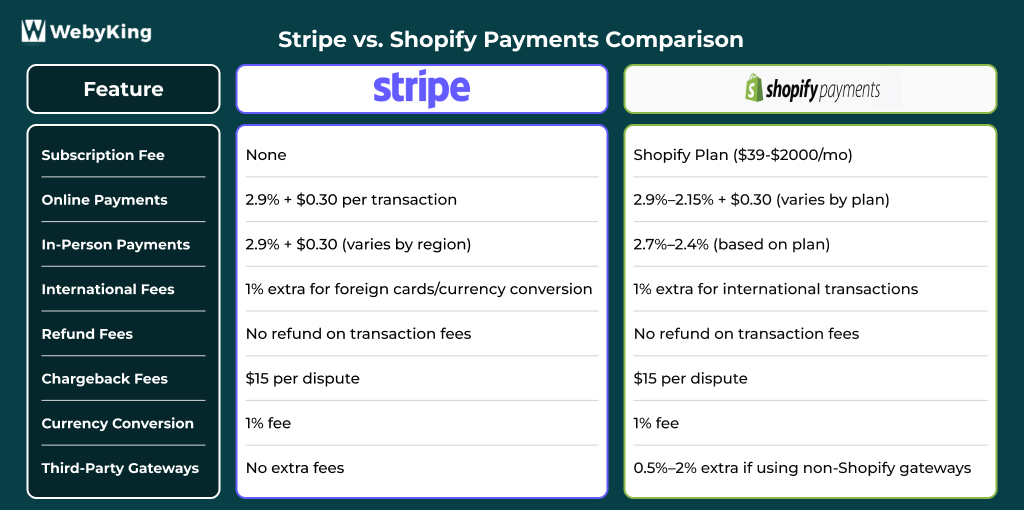

Pricing: Stripe vs Shopify Payments

When it comes to pricing, both Stripe and Shopify Payments offer transparent and competitive rates. They aim to make payment processing simple and clear, with no hidden fees. However, the total cost of using either service can vary depending on the plan you choose and your business needs.

Let’s break down the costs for both payment processors, so you can easily compare and decide what’s best for your eCommerce business.

| Costing Element | Stripe | Shopify Payments |

|---|---|---|

| Subscription Fee | None – Stripe is a standalone payment processor, so you don’t need to sign up for a subscription. | You need to subscribe to a Shopify plan to access Shopify Payments. Pricing tiers: – Basic: $39/month – Advanced: $399/month – Plus: $2000/month |

| Online Payment Processing Fee | 2.9% + $0.30 per transaction (for U.S.-based businesses). Additional fees apply for international charges. | Depends on your subscription tier: – Basic: 2.9% + $0.30 – Advanced: 2.4% + $0.30 – Plus: 2.15% + $0.30 |

| In-Person Payment Processing Fee | 2.9% + $0.30 per transaction for in-person payments (using Stripe Terminal), but can vary by region and payment method. | Depends on subscription tier: – Basic: 2.7% + $0 – Advanced: 2.4% + $0 – Plus: 2.4% + $0 |

| International Transaction Fees | 1% fee for international cards and currency conversions (in addition to the standard processing fees). | Same 1% fee for international transactions, but only applicable if you’re using Shopify Payments. |

| Refund Fees | Stripe does not refund its transaction fee on refunds. You’ll be charged the standard processing fee even if the payment is refunded. | Shopify Payments does not refund the transaction fee if the payment is refunded. However, it is handled similarly to Stripe in this regard. |

| Chargeback Fee | $15 per chargeback (Stripe charges a fee if a customer disputes a transaction). | $15 per chargeback (charged by Shopify Payments when a transaction is disputed). |

| Currency Conversion Fees | 1% fee for currency conversions if you’re processing payments in a different currency than your account’s base currency. | 1% fee for currency conversions when you accept payments in different currencies than your base currency. |

| Transaction Fees for Third-Party Payments | Stripe does not charge any extra fees for third-party integrations. However, if you use other software or platforms to process payments, there may be additional costs. | Shopify Payments does not allow you to use third-party processors without paying an additional fee. If you choose an external gateway, Shopify charges a fee ranging from 0.5% to 2% on top of the processing fees, depending on your plan. |

| Integration Flexibility | Stripe can be integrated with a wide range of platforms, including eCommerce websites, mobile apps, and marketplaces like WooCommerce, Magento, and more. | Shopify Payments is integrated directly into the Shopify platform and cannot be used separately. It works best for businesses that already use Shopify to run their stores. |

Understanding these details will help you choose the best payment processor for your business based on your sales volume, subscription tier, and whether you’re selling online, in person, or both.

Stripe vs. Shopify Payments: Which is Better for Your Online Business?

As we’ve seen, both Stripe and Shopify Payments have their unique strengths and differences.

- Shopify Payments is a fantastic choice for those who already use Shopify to run their store and want a seamless, all-in-one solution that simplifies both online and in-person payments.

- On the other hand, if you prefer a pay-as-you-go model, or if you need to integrate payment processing with a variety of platforms and marketplaces, Stripe is an excellent option.

At Webyking, we specialize in helping businesses like yours integrate the best payment solutions for your needs. Whether you choose Shopify Payments or Stripe, we’re here to ensure a smooth and efficient integration that helps your business thrive. Contact us and we will help you in choosing and setting up the perfect payment gateway for your store today!

Frequently Asked Questions

What is the main difference between Stripe and Shopify Payments?

Stripe is a standalone payment processor that integrates with many platforms, offering high customization. Shopify Payments is built specifically for Shopify stores, providing seamless integration within the Shopify ecosystem.

Which payment processor has lower fees: Stripe or Shopify Payments?

Shopify Payments typically offers lower transaction fees, especially if you use Shopify’s higher-tier plans. Stripe charges a flat rate of 2.9% + 30¢ per transaction plus additional fees for international payments.

Can I use Shopify Payments if I don’t have a Shopify store?

- No. Shopify Payments is only available for stores hosted on the Shopify platform. If you don’t use Shopify, Stripe or other third-party gateways are better options.

Does Stripe support international payments?

Yes. Stripe supports payments in over 135 currencies globally but charges an additional 1% fee for currency conversion and international card transactions.

Are there any refund fees with Stripe or Shopify Payments?

Both Stripe and Shopify Payments do not refund transaction fees when you issue a refund to customers. You still pay the original processing fees.

How fast are payouts with Stripe compared to Shopify Payments?

Stripe typically processes payouts within two business days, while Shopify Payments offers faster payouts depending on your Shopify plan, often within 2–3 business days.

Is Shopify Payments better for in-person sales?

Shopify Payments integrates with Shopify’s POS system, making it very convenient for physical stores. Stripe also supports in-person payments via Stripe Terminal but requires more setup.

Ravi Makhija, the visionary Founder and CEO of WebyKing, is a seasoned digital marketing strategist and web technology expert with over a decade of experience. Under his leadership, WebyKing has evolved into a premier full service web and marketing agency, delivering innovative solutions that drive online success. Ravi’s deep understanding of the digital landscape combined with his passion for cutting-edge technologies empowers him to consistently exceed client expectations and deliver results that matter.